The Wisconsin Department of Revenue is out with its annual Equalized Values Report, and it shows continued increases in value both statewide and in Sheboygan County.

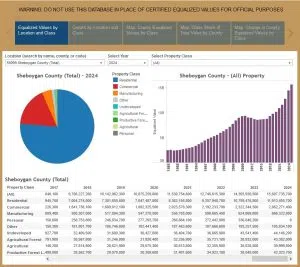

Sheboygan County’s equalized value of all property is now $15,607,735,700, an increase of 8.43% over 2023. Statewide the total equalized property value as of January 1, 2024 was $907 billion, an 8% increase over the previous year. Oconto County had the largest increase at 16% followed by Lafayette and Pepin both reporting 14% increases.

Sheboygan County’s equalized value of all property is now $15,607,735,700, an increase of 8.43% over 2023. Statewide the total equalized property value as of January 1, 2024 was $907 billion, an 8% increase over the previous year. Oconto County had the largest increase at 16% followed by Lafayette and Pepin both reporting 14% increases.

$59.3 billion of Wisconsin’s total growth in equalized value was due to market value increases of 7%, while $14 billion was attributed to a 2% growth in new construction. The greatest increase by class was seen the undefined category called “Other” classes of property at 14%, with Ag forest coming in second at 13%. The greatest loss was a bookkeeping change due to the exemption of personal property valuation by Act 12, which removed nearly $11 billion from the books.

The City of Sheboygan saw total equalized value increase by 12.17% to $4,716,360,500.

The City of Sheboygan saw total equalized value increase by 12.17% to $4,716,360,500.

Sheboygan Fall’s total equalized value increased by 7.48% to $991,596,100.

Sheboygan Fall’s total equalized value increased by 7.48% to $991,596,100.

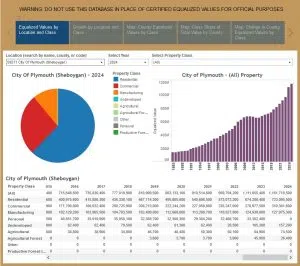

Plymouth’s total equalized value increased by 4.5% to $1,161,710,500.

Plymouth’s total equalized value increased by 4.5% to $1,161,710,500.

Comments