Sheboygan County residents would pay the lowest property tax rate since 1985 if the new proposed budget is passed.

The new framework for spending was introduced at last night’s County Board meeting by Administrator Adam Payne, who said the document “reflects tremendous teamwork among County Board Supervisors, Department Heads and many others.”

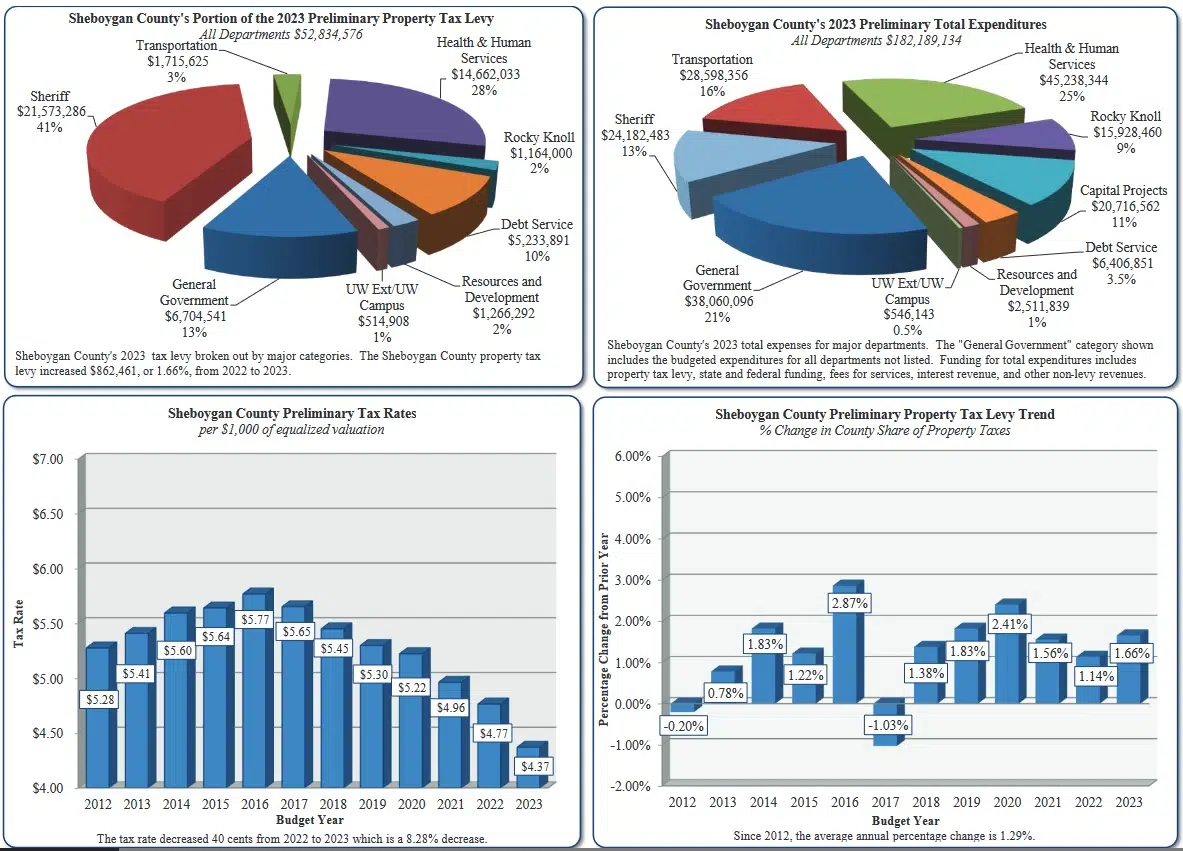

Although the property tax levy would increase by 1.66% in 2023, an increase in equalized property value will more than offset the rise, decreasing the tax rate to $4.37 (per $1,000 equalized valuation), a reduction of 40-cents…or 8.28%…from this year. Of the $182 million annual budget, state and federal revenue, fees and service charges will cover all but $53 million.

Some highlights of the budget include staffing and facility upgrades at Rocky Knoll, wage increases for Corrections and Emergency Dispatch staff, repairs and upgrades at the Jail and Detention Center, adding a 5th Judicial Assistant, increased funding for child welfare and behavioral health services, replacement of the Sheboygan Marsh Dam and improvements to the Sheboygan County Airport.

The proposed budget, the final one under soon-to-retire County Administrator Payne, will now be reviewed by the County Board before eventual passage.

Comments